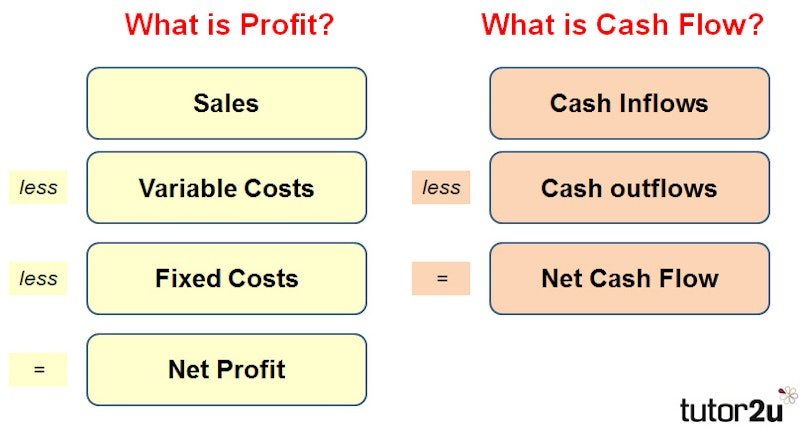

Reconciliation ensures your books reflect reality—not assumptions.

What reconciliation is

It’s the process of matching your records with bank, card, and payment gateway statements to catch errors, duplicates, or missing entries.

Weekly vs monthly cadence

- Weekly: High-volume businesses, e-commerce

- Monthly: Service firms, consultants, freelancers

More frequent reconciliation means fewer surprises.

Simple workflow to follow

- Download statements

- Match transactions

- Investigate mismatches

- Lock the period

- Review summary reports