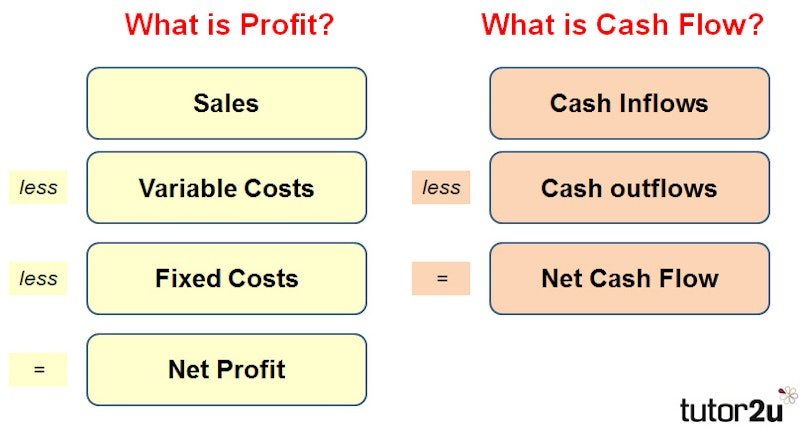

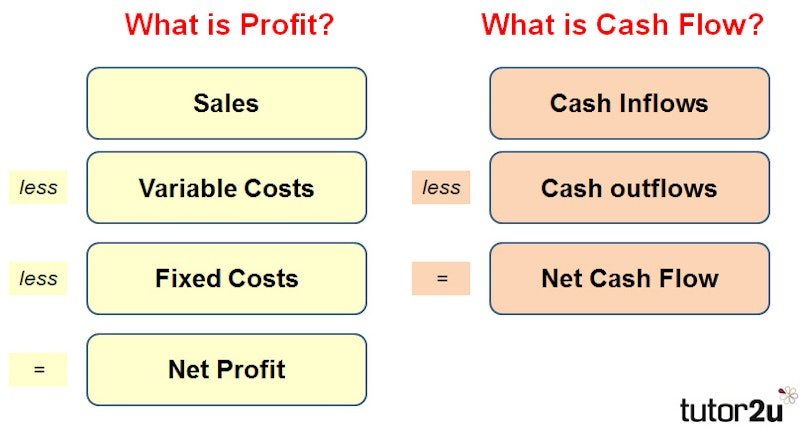

Reading P&L and balance sheet

Understand performance and stability.

Identify 3 key actions each month

Cut costs, raise prices, or improve collections.

When to pivot vs optimize

Data guides timing—not emotions.

Understand performance and stability.

Cut costs, raise prices, or improve collections.

Data guides timing—not emotions.

Growth without margin is dangerous.

Know how many months you can operate.

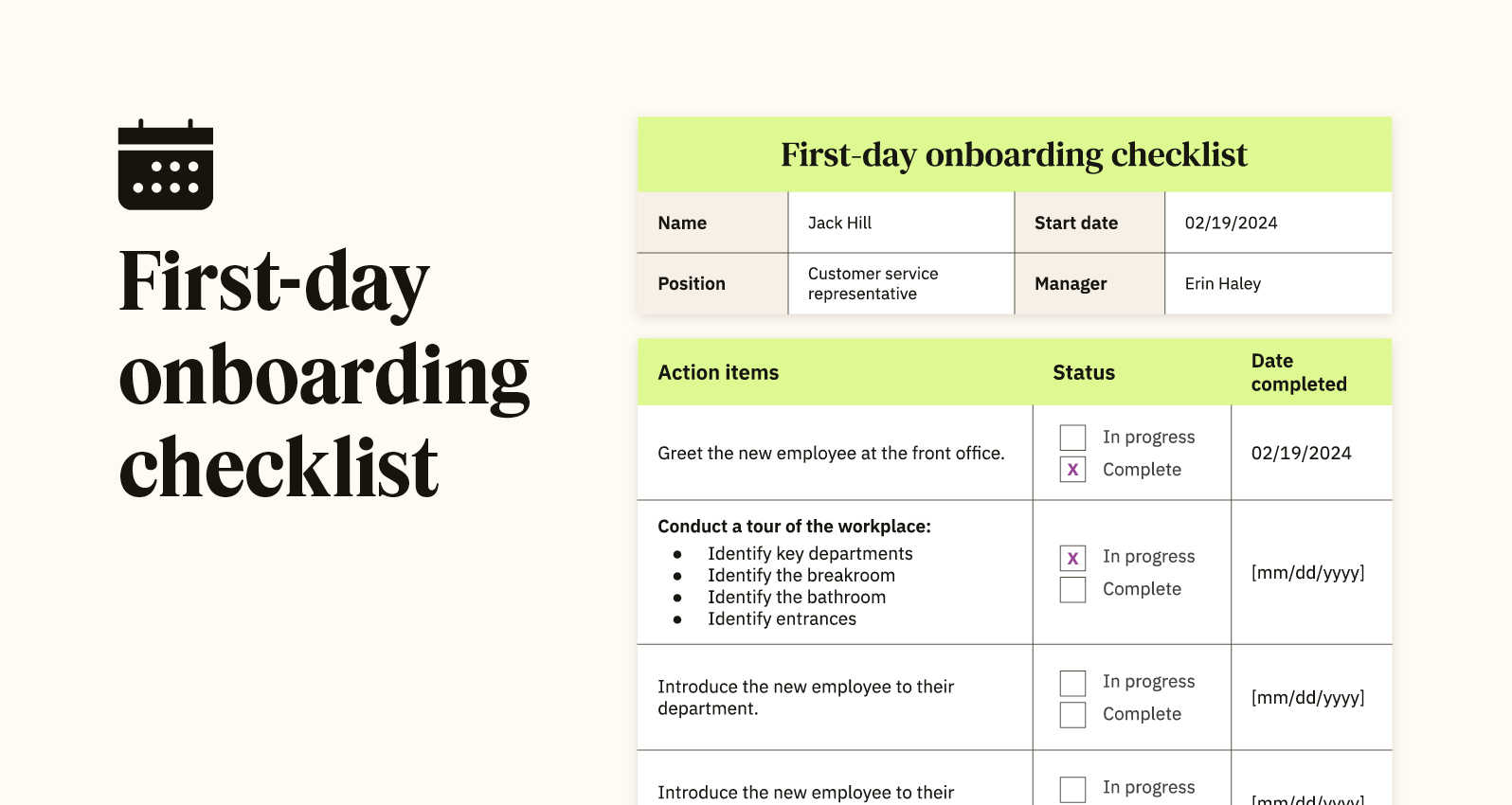

Staff cost vs output.

Revenue, cash runway, payroll ratio.

Accounting, payroll, banking.

One page showing health, risks, and trends.

AI learns patterns and tags expenses.

Scan and extract data instantly.

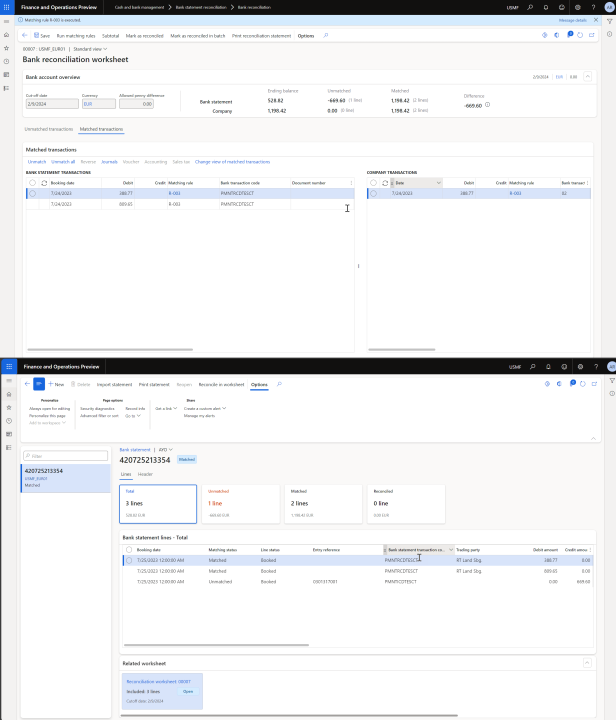

Flags mismatches automatically.

Unusual spend? AI spots it fast.

Accounting data, payroll files, tax records.

Daily automated backups.

A backup is useless if it can’t be restored.

Strong passwords, MFA, role-based access.

Secure Wi-Fi, updated devices, antivirus.

Most breaches start with phishing—training matters.

PF, ESI, tax deductions, minimum wage compliance.

Payslips must be issued and records retained for audits.

Software reduces errors and ensures compliance as teams grow.

Employees require statutory benefits; contractors don’t—but misclassification is risky.

Penalties, back taxes, and legal disputes.

Cash receipts, foreign payments, and platform income are often missed—triggering scrutiny.

Without invoices or proof, expenses may be disallowed during audits.

Periodic reviews catch issues early, correct classifications, and ensure accurate filings.

![Key Tax Deadlines Small Businesses Must Track in [Year]](https://news.genausolutions.com/wp-content/uploads/2026/01/best-accounting-table.jpg)

Missing deadlines leads to penalties—even if you owe zero tax.

Use calendar alerts, accounting software reminders, or delegate compliance tracking to professionals to avoid last-minute stress.